Whitebird, a relative newcomer to the corrugated industry, is making significant headway into key markets with innovative sales and marketing strategies and state-of-the-art printing technology. Located about 65 miles north of Buffalo, N.Y. in Hamilton, Ontario, the 41-year-old company began as a commercial graphics supplier and morphed into commercial printing. As the commercial printing market began to decline in the 1990s, founders Henry Heikoop Sr. and Jack Tamminga transitioned to selling paper sanitation supplies. In the early 2000s, motivated by the entry of a major box supplier into the Toronto market, they expanded into corrugated.

“With a leap of faith we stocked 350 to 400 sizes of corrugated boxes, not having any customers for them,” says Whitebird President, Hendrik Tamminga, Jack Tamminga’s son. “Knowing that a major competitor would eventually take over our market we needed to try to compete. That really got us on the map. Within a year, all of those sizes rotated out of inventory and we started gaining quite a bit of traction in the corrugated space.”

Gradually, customers began asking for custom corrugated so Whitebird set up a design department. And for a few years the company had a corrugated converting facility in Lewiston, N.Y., but sold that in 2015 and expanded its Ontario plant. The company has 82 employees. Hendrik Tamminga and William Heikoop, VP and Henry’s son, are second generation owners.

Strategic Alliances

Whitebird operates from two side-by-side 20,000 and 100,000 sq ft buildings connected by a tunnel. About one-third of the space is dedicated to production and the rest is for distribution, such as stock and release for clients. “We have clients that have 23 SKUs just-in-time where we have to move product every day so we stock inventory,” Hendrik says. “We also stock packaging and sanitation supplies so we’re very unique. This requires more space than most other competitors in our market. We’re able to serve from front door to back turnkey with our customers.”

The range of supplies is extensive and includes specialty wooden crates, sanitation supplies and equipment, anti-corrosion products, coffee and cafeteria supplies. “We even have toilet paper,” Hendrik jokes. Corrugated packaging and stock boxes represent about 70% of total sales.

Aside from the wide variety of supplies, what makes Whitebird particularly unique in the corrugated market is its relationship with other independents and integrated companies. “The majority of our projects that go to our customers are run through farm outs and strategic alliances with integrated and sheet plants,” he says. “Our specialty is running the strengths of our vendors so we know who is the best from a pricing and quality standpoint for jumbos, die-cutting, three- and four-color jobs, and litho. We pull the strengths of all of our vendors and decide at the time the routing of where we want to put the job based on the competency of our partners. We’re one of the very few in our industry that has alliances with most of our competitors.”

Explaining this further, he says, “We got into production in a large way only four years ago. One of our mentors in our industry sat in our board room about four weeks ago and said, ‘I’ve never seen a company move at the speed that Whitebird got into this market.’ We have to be very careful that we don’t overwhelm our team and that we don’t put too much pressure on our production schedules. We’re just simply not running all the product through Whitebird’s machines. We run through our vendor partners. That’s a long-term strategy for us.

“We will continue to use companies like Atlantic Packaging, WestRock, Cascades, Georgia-Pacific,” he continues. “We have many different vendor partners in the Toronto area. For instance, we don’t run triplewall, or maybe just very low quantities, but we will run large orders with some of the integrateds or we may run large stock box orders on WestRock’s Evol or Atlantic’s Evol. We leverage the strengths of our vendors to produce orders for us.”

This relationship helps Whitebird provide quick turnaround and responsiveness to customers, which is one of the company’s core values. “We have very itchy feet when it comes to paper sitting on our desk for clients. We love getting stuff out quickly,” Hendrik says. “It is our absolute pleasure and this is no exaggeration that we love turning stuff out quickly for our clients. That’s our specialty or niche in our market.”

Adding Digital

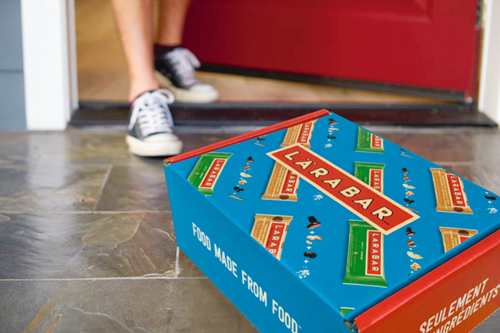

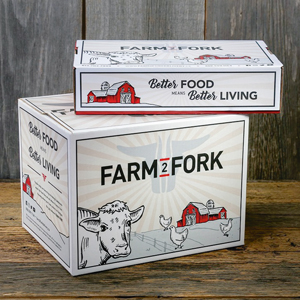

Two years ago Whitebird identified another opportunity to stand out in the market. Recognizing that the corrugated industry was extremely competitive, Hendrik says Whitebird needed to differentiate and add value to the box. That strategy led them to expand into multi-color graphics and e-commerce packaging and ultimately digital printing. In late 2018 the company installed an EFI Nozomi C18000, said to be the first single-pass, ultra high-speed digital production system in Canada. Installing the Nozomi has helped expand the business into e-commerce subscription boxes, point-of-purchase displays and retail-ready packaging. Some of this business is for other corrugated converters that may have minimal or no digital printing capabilities.

George Perreira, VP of Client Experience and Digital Print, says the majority of orders are generated by the outside sales team. However, the daily volume of leads through online inquiries is rapidly increasing. “We have been generating over the past year a tremendous amount of inquiries and leads for high graphics printed boxes, products that we would run off our Nozomi,” he says. “We’re seeing an uptick in customers that are outside of brick and mortar who are ramping up and looking to increase volume because their demand right now is increasing because of the situation (COVID-19). Companies all over are changing their process to adapt to what the needs are right now in society. We’re seeing the demand and drive for packaging as companies shift their focuses and require new packaging for these items.”

George Perreira, VP of Client Experience and Digital Print, says the majority of orders are generated by the outside sales team. However, the daily volume of leads through online inquiries is rapidly increasing. “We have been generating over the past year a tremendous amount of inquiries and leads for high graphics printed boxes, products that we would run off our Nozomi,” he says. “We’re seeing an uptick in customers that are outside of brick and mortar who are ramping up and looking to increase volume because their demand right now is increasing because of the situation (COVID-19). Companies all over are changing their process to adapt to what the needs are right now in society. We’re seeing the demand and drive for packaging as companies shift their focuses and require new packaging for these items.”

In addition to the Nozomi, the manufacturing floor has two digital cutting tables from Colex Finishing, Inc., a United Flexus rotary die-cutter, a Langston flexo folder-gluer, a Bobst specialty folder-gluer and a Marumatsu flatbed die-cutter. “A lot of the products that come off the Nozomi are going to second or third processes,” says Peter Tamminga, Operations Manager and Hendrik’s cousin. “A larger percentage of the e-commerce business is a mailer type box, which only has to go to a die-cutter. But we do have a number of end-user packaging that is large RSCs that we run through either two processes or if possible a single process folder-gluer if necessary.”

“The reason why we have equipment in our building is to help us with lead times,” Hendrik says. “Those that need to turn stuff on a dime we would run at our own plant because we have more control. It really depends on the client’s needs and where we’re at in the schedule.”

Referencing the results of COVID-19, he says, “Customers are seeking speed right now, in responsiveness and production. We win orders by returning estimates within the hour. We are gaining orders by reducing lead times from weeks to days. Our CSR team, although working remotely, is easily accessible and very responsive to our customers. We have reworked our back end processes to free up our design team, so they can offer more support for brand owners looking to quickly launch new packaging.”

New capital equipment investments are being considered. Peter says this includes another die-cutter, preferably one that is more focused on die-cutting and less on printing, and more automation tables. “Anything that revolves around the digital equipment is probably going to take precedent right now. That could mean simply a rotary or an automation table or it could mean a replacement or an additional flatbed,” he says. “We don’t want to make a quick decision. We’re testing the waters right now to see what kind of cut and the best quality we’re getting off of one machine.”

Right now the main focus is building out capacity on the Nozomi. “I would say the sweet spot on that machine is anywhere between 500 and 3000 pieces, but there is plenty of capacity that we have left on that machine so we’re pushing hard in the sales area to keep that moving,” Peter says.

Right now the main focus is building out capacity on the Nozomi. “I would say the sweet spot on that machine is anywhere between 500 and 3000 pieces, but there is plenty of capacity that we have left on that machine so we’re pushing hard in the sales area to keep that moving,” Peter says.

Hendrik has a few words of advice for board converters looking to incorporate digital printing in their facilities. Understand your cash flow, your client needs, the upfront process, pricing and have a strong network of partners. “The digital space is very different than the legacy business. We were somewhat prepared for it but not entirely,” he says. “Anyone getting into it, first and foremost should understand their cash flow needs. There are a lot of upfront costs. And it takes longer to land digital orders. The sales cycle is longer so you don’t get a return as quickly as you would backfilling on a legacy press.

One Stop Shop

With the addition of digital printing, Whitebird has become even more valuable to its customers. “As a value proposition we can surround the customer,” Hendrik says. “Our focus is to help with e-commerce packaging and to help market products and add color to corrugated board.” He says some customers started with small orders of 25 boxes and are now multi-million dollar companies. “I’m not going to take credit for their growth but we have definitely helped them with the packaging and stand out in their market. Along with that they don’t have to worry about the supply chain because we deal with it all. That’s a huge value add that’s not easy to market, but people understand it once we start to partner with them.”

He says some clients have been purchasing boxes for five years and just realized Whitebird also sells tape. “It doesn’t come easy for us to move commodities with the product, but there’s definitely something that our reps are taught to do.”

The message to customers is, “We can save you money by consolidation. We want to consolidate your spend. You focus on your core business. We will help you with the supply chain.”