Saica Pack, the third largest European producer of recycled paper for corrugated board, has officially expanded into the US market, starting up its first box plant in April. Located in Hamilton, Ohio, about 20 miles north of Cincinnati, the 360,000 sq ft greenfield plant is a model of efficiency and automation, exemplifying European innovation in every detail.

The plant is in the process of building volume, courting a list of high profile customers, and is currently operating one shift with 32 employees. The goal is to have 120 employees by the end of 2023 operating three shifts. The production capacity target is 140m sqm (1,500,000 MSF) per year of corrugated board, which Gonzalo Aragüés, Industrial Projects Director, says will be achieved by 2029. The projected target for this year is 25m sqm (265,000 MSF).

Customers are primarily consumer goods companies in the logistics and food and beverage markets. The US plant also provides corrugated sheets to local sheet plants. The percentage mix of shipped boxes versus sheets is 50/50 with the goal of changing that to 80% boxes and 20% sheets. Box styles are mostly single and two-color RSCs and trays. About 10% of finished goods is warehoused on-site.

Focus on Automation

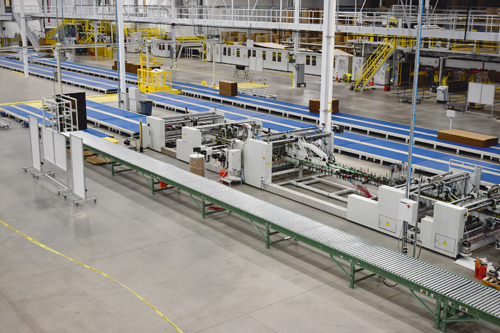

The modern two-storey plant is expansive. The reception entrance, administrative offices and training and conference centers are inviting spaces with brightly painted walls, contemporary décor and large windows that provide natural lighting. The manufacturing area is clean, well-lit and features an ergonomic floorplan and the newest technology. The second floor provides access to an extensive mezzanine and catwalk that spans the entire perimeter of the production area, providing a bird’s eye view of the corrugator, paper roll storage, converting and gluing, finished goods storage and the intricate material handling system.

When designing the plant floor layout and choosing equipment Saica took a very European approach, installing highly automated machines and material handling components best suited for increased quality, shorter lead times – within one week – and fewer operators. “Finding people was a big challenge. But luckily we have very good technology in the plant so I don’t need as many people as other companies because we have a lot of automation,” says Akin Burak Önder, General Manager. “This is a big advantage. Automation is key. Our industry does not have the best profit margins. You need some balance and investments in automation and what we did here was a very correct decision.”

The plant has a four-color Bobst FFG 1228NT RS and a four-color Bobst DRO 1628NT RS RDC with Speedstack and Speedpal, Bobst’s latest stacker and palletizer. The flexo folder-gluer has Valco Melton quality assurance systems for checking glue applications and gap and a Vistron Print Inspect system. Two additional print stations can be added to both machines if needed.

For specialty gluing, the plant runs a Vega 290 folder-gluer that can glue up to 6 points for autobottoms/crash lock and glued trays. The machine is equipped with Vega Easypack and Rotopack for the semi-automatic and automatic collection of boxes. Easypack counts and separates the shingled folded boxes from the folder-gluer pressure mat to create parcels of boxes and Rotopack rotates, overturns and overlaps every single half parcel, preparing it for the most suitable palletizing process. Automation on the gluer has reduced the number of operators to two. Strapped bundles are transported via conveyor back around to the infeed so one operator can feed sheets and unload finished product.

As part of the plant’s second phase, Saica will be adding a four-color Bobst FFG 820 and a two-color Bobst 1628 NT RS RDC, to be operational in the second half of 2023. The machines will be mirrored with the ones already on the floor so the controls are easily accessed by one operator.

The 2.8m (110″) Fosber corrugator is a 420m per min (1375 FPM) doublewall, double level 400 Series with Link M2 splicer/roll stand technology and sound enclosures around the singlefacers. The M2 automatic roll stand splicer combination is suitable for longer runs for national account business. While many of Saica’s European facilities have Fosber’s M3 technology which allows the corrugator to run at high speed even when running shorter orders, Aragüés explains that Saica is taking a different approach with the US market. “We believe the orders are going to be significantly larger than in Europe. The M3 is beneficial when you have smaller orders because you can put the paper rolls in sequence and do a splice very quickly. Here we didn’t find the need.”

Fosber’s Pro/Care and Pro/Quality systems monitor and provide data for the upkeep of the machine and inspect the board for defects. Saica uses its own proprietary software for scheduling.

The corrugator’s steam recovery system is from Baviera and BSP, the starch kitchen is from Ringwood and the starch is supplied by HarperLove. “One interesting thing about our effluent and starch kitchen is that we are treating the wastewater and reusing the treated water for starch production,” Aragüés says. “We are reusing 80% of the process water for the production of the starch.”

The corrugator runs E, P, B, and C-flute and B/C, B/E, and P/C doublewall. About 5% of the sheets off the corrugator is doublewall.

While the intent is to run lighter weight basis weights, the corrugator is currently producing more conventional 32 and 44ECT. “Right now we are producing what our competitors are producing but as we get better established in the US we will be producing our high performance recycled lightweight paper,” Aragüés says.

First Vertical WIP Storage

The WSA Material Handling System is fully automated from corrugator through the finished goods line and is controlled by WSA’s and KTC’s iFAS Smart Factory automation system, a PC based software package that is integrated with Saica’s ERP System and other OEM equipment which drives the sending and receiving of order information and other critical data used to track every load across the plant in real time.

Sheets coming off the corrugator travel in one of three directions. 1. To a vertical WIP storage area (WSA’s and Warak’s first of its kind in North America); 2. To the finished goods line for strapping on two EAM Mosca strappers; or 3. To the converting machines.

The decision to integrate a vertical WIP warehouse as opposed to traditional floor conveyor was considered from the very beginning as this solution has been well proven in recent years in Europe, according to Jim McLaughlin, President of WSA-USA LLC. It offers significant benefits in optimizing storage capacity, reducing building size and cost, minimizing energy consumption, lessening product handling, and maximizing plant efficiencies in how product is scheduled and run on the corrugator.

The vertical WIP warehouse at Saica Pack Hamilton has a footprint of 11,000 sq ft and is positioned outside the main factory building on a concrete slab. The rack is eight levels high, includes 384 cells, is serviced by two Korber Stacker Cranes and can store approximately 10,000,000 sq ft of product which includes both primary and secondary WIP. The total power requirements for the system with two stacker cranes is 180 amps. “For comparison purposes, a traditional WIP system for a factory of this size would occupy a space of 40,000 sq ft yet would only be able to accommodate 5,000,000 sq ft of product and would require over 500 amps of power,” McLaughlin says.

The vertical WIP warehouse at Saica Pack Hamilton has a footprint of 11,000 sq ft and is positioned outside the main factory building on a concrete slab. The rack is eight levels high, includes 384 cells, is serviced by two Korber Stacker Cranes and can store approximately 10,000,000 sq ft of product which includes both primary and secondary WIP. The total power requirements for the system with two stacker cranes is 180 amps. “For comparison purposes, a traditional WIP system for a factory of this size would occupy a space of 40,000 sq ft yet would only be able to accommodate 5,000,000 sq ft of product and would require over 500 amps of power,” McLaughlin says.

WSA also provided a fully automatic Tooling Delivery System that delivers tooling carts including ink, printing plates and cutting dies to and from the mezzanine to each converting line and waste carts from the converting machines to the baler room. This will be integrated with a new SERRA Fully Automatic Die and Printing Plate Rack system in July.

The material transport and vertical WIP offers many benefits, Önder says. “We are not touching the box. In terms of quality and service there is no bottleneck for runnability so you can run the corrugator 24 hours and store sheets and you’re not touching the sheets so the performance and the quality will be much better.”

Aragüés says, “We are able to separate the customer’s fluctuations on the converting machines from the corrugator because we have such a big buffer between the corrugator and the converting machines that we are able to optimize production on the corrugator and we’re able to produce very long runs because we have this huge storage capacity between corrugating and converting.”

“It gives us better lead times and quality,” Önder adds. “That is our competitive advantage when we say performance packaging with quality and service in terms of offering to the market paper, product, and innovative solutions.”

Market Differentiation

Saica’s key differentiator for the US market is going to be its lightweight packaging and different flute combinations, such as P-flute which is not a common flute in the US. “We are an expert in producing lightweight paper and high performance packaging that compares to higher grade packaging from other competitors,” Aragüés says.

Initially, the plan was to import paper to the US from Saica’s European paper mills, however, supply chain issues torpedoed that strategy. “If we want to do things differently, we need to have our paper, but right now trying to bring our paper from Europe is pretty crazy because of the freight rate so we are buying the paper from local suppliers,” he says. “As soon as the supply chain constraints that we are suffering globally ease a little bit, we will be importing more of our papers and then have a paper mill here.”

About five years ago, Saica’s European plants began producing high quality flexo printing – up to 7 and 8 colors – on white coated brown recycled paper. This is something the company is planning to introduce to the US market. Indeed, the strategy in the US is to provide distinctive products, such as white coated paper and high-end printing. Ideal markets for these products include beverage and FMCG customers for national and global companies, such as P&G, Unilever, Amazon, Nestle, and Diageo, many of which Saica already has a relationship with in Europe. “We are targeting to have those customers here, but they want us to be bigger here,” Aragüés says.

Saica is planning to build three more plants and a paper mill in the US; a second facility has already been announced for Ohio or Indiana. “With the four box plants, we think that one of them will be very close to the paper mill.”

Aragüés says Saica’s strength in the US market is service, quality and high performance packaging. “Because of our high automation, we are able to offer better service and because of our quality inspection systems we are able to offer better quality.”